While HP’s CEO transition garnered attention, CIOs must prioritize HP’s ability to demonstrate AI PC return on investment, manage endpoint expenses effectively, and deliver on crucial edge computing applications.

<div class="media-with-label__label">

Image Credit: Ken Wolter / Shutterstock </div>

</figure>

</div>

</div>

</div>

</div>The technology sector was surprised recently by the abrupt resignation of HP CEO Enrique Lores, who departed the computing powerhouse to lead PayPal.

However, industry analysts suggest that HP is well-positioned to navigate this leadership change, provided it can successfully deploy AI PCs, clearly demonstrate their ROI, innovate with new edge computing scenarios, and maintain a competitive balance between product pricing and technological advancements.

Here’s an overview of what businesses can anticipate from HP in the upcoming year.

Proving ROI for AI PCs Remains a Significant Challenge

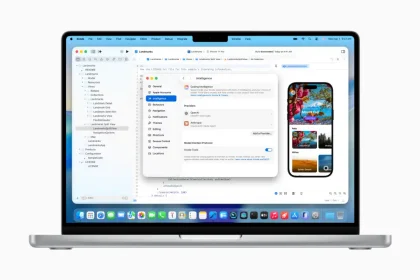

Despite considerable excitement and continuous technological advancements surrounding AI PCs, enterprise adoption lagged in 2025, primarily due to uncertainties regarding cost and return on investment. HP has aggressively entered this market segment with its Copilot+ laptops, including the OmniBook X, EliteBook X, and OmniBook Ultra, featuring Qualcomm Snapdragon X Elite and Intel Core Ultra processors.

Specifically, HP recently unveiled its EliteBook X G2 Series, offering a broader selection of processor configurations, and has emphasized keyboard-centric PCs designed for hybrid work environments.

Nonetheless, the market is in its nascent stages, and businesses are questioning the additional expenditure required for AI PC upgrades. While “fringe edge-side applications” exist, as highlighted by John Annand, digital infrastructure practice lead at Info-Tech Research Group, numerous IT decision-makers struggle to identify AI’s practical role within their organizations. Pinpointing the precise ROI remains “vague.”

“We haven’t yet discovered the definitive killer application for an AI chip integrated into a local PC,” Annand remarked.

Sanchit Vir Gogia from Greyhound Research echoed this sentiment, stating, “Uncertainty around ROI presents a significant risk.” His company’s findings indicated that although 57% of CIOs are assessing AI PCs during refresh cycles, merely 19% have sanctioned widespread deployment, and an even smaller percentage can directly link device-level AI to key business performance indicators.

Consequently, HP needs to articulate the ROI of AI through controlled pilot programs, measurable results, and demonstrating value tailored to specific roles, according to Gogia. He advises, “CIOs should press HP and its competitors to illustrate the tangible improvements,” across metrics like battery longevity, productivity gains, and reductions in IT support requests.

“The arrival of the new CEO coincides with a highly challenging period for the PC sector,” observed Anshel Sag, principal analyst at Moor Insights & Strategy. Although 2026 was anticipated to be a “major refresh cycle” due to the end-of-life (EoL) for Windows 10, the confluence of memory and other resource scarcities means that demand will probably not be met, exacerbated by Microsoft’s “ill-timed and unclear communication.”

Undeniably, there’s an ongoing imperative to validate AI’s benefits and enhance on-device user experiences, Sag added. He commented, “HP’s advantage lies in its highly diversified supplier network, which should enable it to navigate these challenges effectively.”

Memory and Supply Chain Hurdles

A significant hurdle is the current memory scarcity; Gartner projects end-user price increases between 15% and 40%. This situation is simultaneously prompting “widespread panic buying” and encouraging businesses to “utilize existing assets until their absolute end,” explained Gartner analyst Autumn Stanish.

“An increasing number of companies are opting to redeploy or acquire refurbished non-AI PC devices to mitigate the impact of the shortage, deferring the evaluation of an AI upgrade until later in 2027,” she stated. HP could potentially capitalize on this by promoting its Renew Services portfolio, offering more affordable secondary devices, though this doesn’t appear to be a primary marketing focus.

Businesses should also closely track supply chain resilience and diversification, Stanish advised. She characterized this recent shortage as the “second significant supply crisis within the last five years.”

“Stay attentive to HP’s communications or announcements regarding their future long-term strategy, especially as geopolitical tensions, climate concerns, and health emergencies appear to be on the rise,” Stanish recommended.

HP’s Distinctive Approach in the AI PC Landscape

Despite these considerations, HP is favorably positioned to capitalize when the demand for AI PCs eventually escalates.

The company’s approach is unique due to its holistic focus on the complete enterprise technology stack, extending beyond mere chip specifications, observed Greyhound’s Gogia. HP integrates AI PCs with telemetry, comprehensive fleet observability, and robust security architecture, demonstrated through its Workforce Experience Platform (WXP) and its support for AMD, Intel, and Qualcomm processors. Furthermore, HP has shown an inclination to develop “innovative” endpoints, such as the EliteBoard G1a keyboard PC.

The importance of the learning curve is also recognized, with HP providing support for tuning and governance, rather than simply “shipping hardware adorned with AI labels,” Gogia explained.

Gogia’s firm forecasts that 2026 will be the year HP deploys AI PCs as managed, role-tailored, edge-ready tools, steering clear of “universal miracle machines.” They also anticipate a strong push into strategic edge applications in areas like remote fieldwork, branch offices, regulated environments, or hybrid work settings where network latency and connectivity can be inconsistent.

Moreover, instead of exclusively advocating for either fully on-device processing or complete cloud offloading, HP is fostering what Gogia termed “a coordinated computation approach.” In this model, local NPUs manage less intensive, real-time operations, while more complex queries are directed to cloud-based copilots. This strategy offers CIOs enhanced cloud cost management and improved data compliance.

Furthermore, HP plans to promote greater silicon diversity, Gogia pointed out. Its forthcoming Snapdragon-powered PCs will be marketed as “highly mobile solutions” offering “equivalent security features” compared to x86 architecture.

Beyond these points, Stanish noted that HP’s WXP and its integrated Wolf security chip are helping to establish HP as a “more comprehensive” digital workplace solution provider, moving beyond its traditional role as solely a hardware original equipment manufacturer (OEM).

On a wider market scale, hardware specifications have become more standardized. Gartner anticipates that mainstream models from all manufacturers will evolve from NPUs with lower TOPS ratings to second-generation NPUs boasting 45-plus TOPS, meeting Copilot+ certification requirements. Consequently, almost all new devices will be categorized as AI PCs, with the majority attaining Copilot+ certification. AI capabilities on PCs will also increasingly expand beyond NPUs to include sophisticated embedded GPUs from Intel, AMD, and Qualcomm.

HP is expected to emphasize the practical advantages of AI PCs, such as improved security, elevated collaboration, self-repairing functions, and broader autonomous operations, over their more speculative or heavily hyped theoretical applications.

Eventually, further functionalities will develop concerning small language models (SLMs), domain-specific language models (DSLMs), light language models (LMs), and other sophisticated features. Nevertheless, “we are far from mainstream adoption for such technologies at present,” Stanish commented.

HP Continues to Explore AI’s Potential for Its Printing Segment

“AI holds relevance for everyone,” stated Keith Kmetz, program VP for imaging, printing, and document solutions at IDC. He added, “The printing market is currently focused on identifying how AI can be integrated into products and services in ways that distinctively set them apart from traditional devices.”

Kmetz highlighted the potential for HP and other vendors to leverage AI for “aftermarket service experiences” and continuous maintenance, alongside driving cost savings and overall labor efficiencies.

Memory expenses and supply limitations are affecting all industries, including printers, and Kmetz anticipated that HP and its competitors would likely transfer these costs to consumers. He remarked, “HP has historically been quite direct about implementing price increases.” While substantial hikes are improbable, prices will “modestly increase” as component and memory costs climb.

“Any product requiring memory will inevitably encounter these heightened costs, which, candidly, most anticipate,” Kmetz concluded.

Consistent Strategy Ahead

The change in HP’s CEO is less of a risk than many CIOs might perceive, Gogia commented. He emphasized, “The board has indicated a commitment to continuity,” and “the overall strategy remains unchanged.” Nevertheless, CIOs should closely monitor HP’s implementation pace, integration plans, and how effectively it responds in the field.

For AI PCs to succeed, HP needs to keep showcasing tangible value—like fewer support tickets, increased productivity, and robust device monitoring—while carefully balancing innovation with prudent pricing, Gogia stated. He warned that AI premiums are gradually affecting “endpoint Total Cost of Ownership (TCO),” and HP’s pricing approach will reveal whether it prioritizes profit maximization or margin protection.

Moreover, enterprise leaders should observe if HP sustains its multi-silicon strategy. Gogia suggested that supporting Qualcomm, AMD, and Intel is “a clever move,” but only if consistency in manageability, patching, and telemetry is maintained. Disparate models tend to erode user confidence.

Customers ought to inquire about the actual value HP delivers, not merely what is promised, and observe if support remains uniform across different regions, as well as if partner responsiveness declines. Gogia also recommended this period as an opportune time to renegotiate service level agreements (SLAs), align technological roadmaps, and validate existing tech stacks.

“CIOs should approach HP’s initial year under new leadership as a crucial performance evaluation,” he concluded.